Digital Shift is an innovative discussion forum for digital Transformation and digital ecosystem accelerator based in Zurich, Meeting regularily and discussing latest trends and topics in this area with a select group of invitees.

https://digital-shift.org/vertrauen/ (in german)

In the February 2017 event, the topic was ‘Blockchain & Trust’ – and I had the honor to speak alongside of seasoned blockchain and bitcoin veterans such as André Wolke (Validity Labs), Jonas Schnelli (bitcoin core developer), Martin Steiger (Steiger Legal).

My focus was the economic angle of trust and how it develops (or, countering the hypotheses that it is simply not needed on a blockchain). It is clear that every economic activity requires a certain amount of trust, so that it can be successful.

According to Niklas Luhmann, trust is a ‘risky advance’. But without this advance, economic transactions would hardly happen. In my presentation I did a thought-provoking experiment: Imagine if you retire tomorrow, the entire pension fund will be paid out to you in one lump sum. But you can chose whether it’s paid in the local fiat currency or in a cryptocurrency, e.g., Bitcoins. If you live in, say, Switzerland, most of us would most probably chose Swiss francs. 95% of the audience correspondingly raised their hands here to get the local currency.

But imagine you live in an emerging, highly volatile market, maybe even a conflict-ridden country, and face the same situation with unstable currency, exploding inflation, corrupt government officials and central bankers on the run: how would you want to store your money? Local currency or Bitcoin? In this scenario more than 80% of the audience raised their hand for Bitcoins. An easy call.

But in what way is trust different with classic fiat currencies and payment systems versus modern cryptocurrencies, which are often based on Blockchain technology?

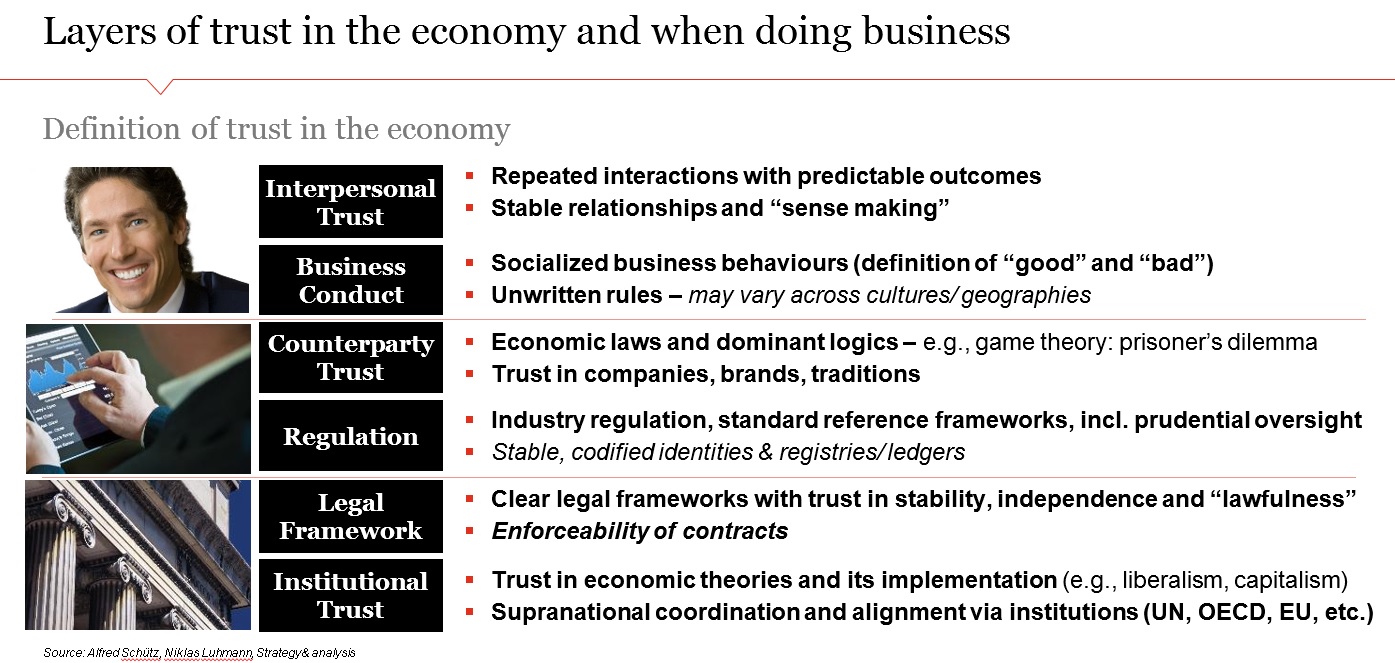

Looking at this question with a cross-disciplinary lens, trust can be analyzed as a layered stack of different types of trust: interpersonal trust, socialized business behavior, trust in counterparties, formal regulation, legal frameworks & trust in institutions and brands.

A closer look at these trust layers and how they are constituted in our economy (in order of individual to institutional):

1. Interpersonal trust

- Repeated interactions with predictable outcomes between people

- Building of stable relationships over time and “sense making” of individual (incl. own) behaviour

2. Business Conduct & Counterparty Trust

- Socialized business behaviours (definition of “good” and “bad” conduct) and “unwritten” rules

- Economic laws and dominant logics – e.g., game theory: prisoner’s dilemma, or theories of rational choice and homo oeconomicus

- Trust in individual companies, brands, traditions

3. Regulation

- Industry regulation, standard reference frameworks, incl. prudential oversight of markets and business conduct

- Stable, codified identities & registries/ ledgers

4. Legal Framework

- Clear legal frameworks set up to promote stability, independence and “lawfulness” of economic transactions

- Enforceability of contracts and punishment of unlawful behaviour, e.g., through courts and judicial systems

5. Institutional Trust

- Trust in economic theories and its implementation (e.g., liberalism, capitalism)

- Supranational coordination and alignement via institutions (UN, OECD, EU, etc.)

Of course, some if not all these layers may vary across cultures/ geographies, but fundamentally our current economic system relies on all of these 5 layers of trust.

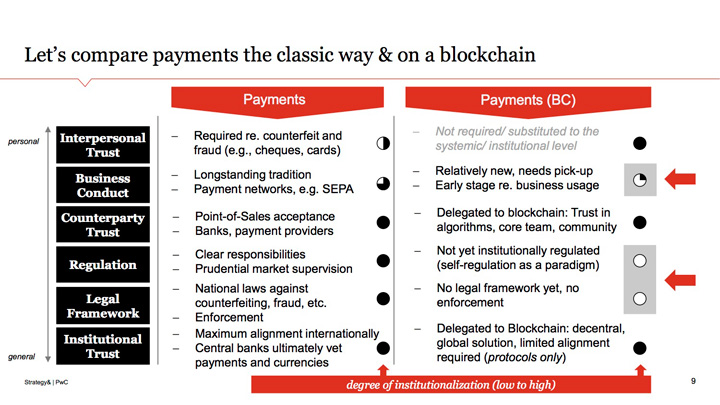

Considering classic banking and payment transactions, again all of these layers are addressed and form part of a closed, mostly institutionally defined framework for transactions.

Introducing new, radical concepts such as distributed ledgers and cryptocurrencies, such as Bitcoin, however, the 5 layers of trust received different priorities, while some of them become entirely insignificant. E.g., interpersonal trust on a Blockchain is replaced by an automated, decentral exchange algorithm but without any intermediary acting as a transaction broker or as an archiver and validator of records. Regulation and legal frameworks remain important, but are still emerging for cryptocurrencies, while institutional trust is completely replaced by trust in protocols, the anonymous crowd of users and stable algorithms that define the way the cryptocurrency economic system is managed.

Extending that rationale to more complex economic transaction, e.g., smart contracts, it becomes evident that especially the regulation and legal layer requires more thinking and practical solutions are required. For example, ways to legally enforce decentral smart contracts in local jurisdictions, or bridging the decentral and local sphere so that economic counterparties can interact across both.

It is quite conceivable that such structures will be created in the future, so that cryptocurrencies and smart contracts will be enhanced with codified attributes or responsibilities will be defined in order to guarantee legal enforceability. At the moment this is not yet the case.

As Bitcoin and other decentralized ledger solutions allows for great efficiency gains, it will permeate into more and more areas of our lives. This means that in the future it will be a big change in who and what we trust: our traditional ways of making transactions will be enhanced, for example, with trust in the peer-to-peer crowd, trust in human machine interfaces, but also trust in bots, robots, or artificial intelligences. In that sense we continue a longlasting social process, where trust in technology becomes a natural part of our daily lives, a process that started basically with the industrial revolution.

Lots of room, thus, for innovation and new social and economic models that leverage distributed ledger technology, blockchains and cryptocurrencies. The future is bright, but trust – in one way or another – as a fundamental predisposition of business activity will remain important in modern societies and economies.

The event was hosted at the Museum for Digital Art (MUDA). A very nice, cosy, interactive and engaging place, if you are in the area, don’t miss it: