In recent years, private banking and wealth management (PBWM) executives have been so busy staying abreast of new regulatory issues that most have understandably had little time to explore the latest developments in technology and assess their impact. But while digital has not yet fundamentally disrupted the PBWM industry, it becomes clear that executives around the world are required to make clear choices on where they want to play in a digital age. Enter WealthTech, as a specialized form of Fintech.

Clients request tailored solutions & “bring back the fun”

The urgency doesn’t necessarily come from attacking Fintech’s, e.g., robo-advisors or digital-only banks, but rather from clients themselves. In a recent study, only 39% of interviewed HNWIs would recommend their current PBWM provider to a friend. With HNWI above $10 M assets-under-management that rate drops – counter-intuitively – even down to 29%. An alarming statistics. Affluent, HNW and UHNW clients clearly want a provider that matches their needs and lifestyle, and provides a tailored, highly customized user experience. They also request more transparency: on risks, on pricing, on peer choices and competitor’s offerings and benchmarks. It’s 2017, after all. The quality of advice, of course, still stands at the heart of a PBWM offering, but clients also want more fun, engagement and entertainment.

Ways to play in WealthTech

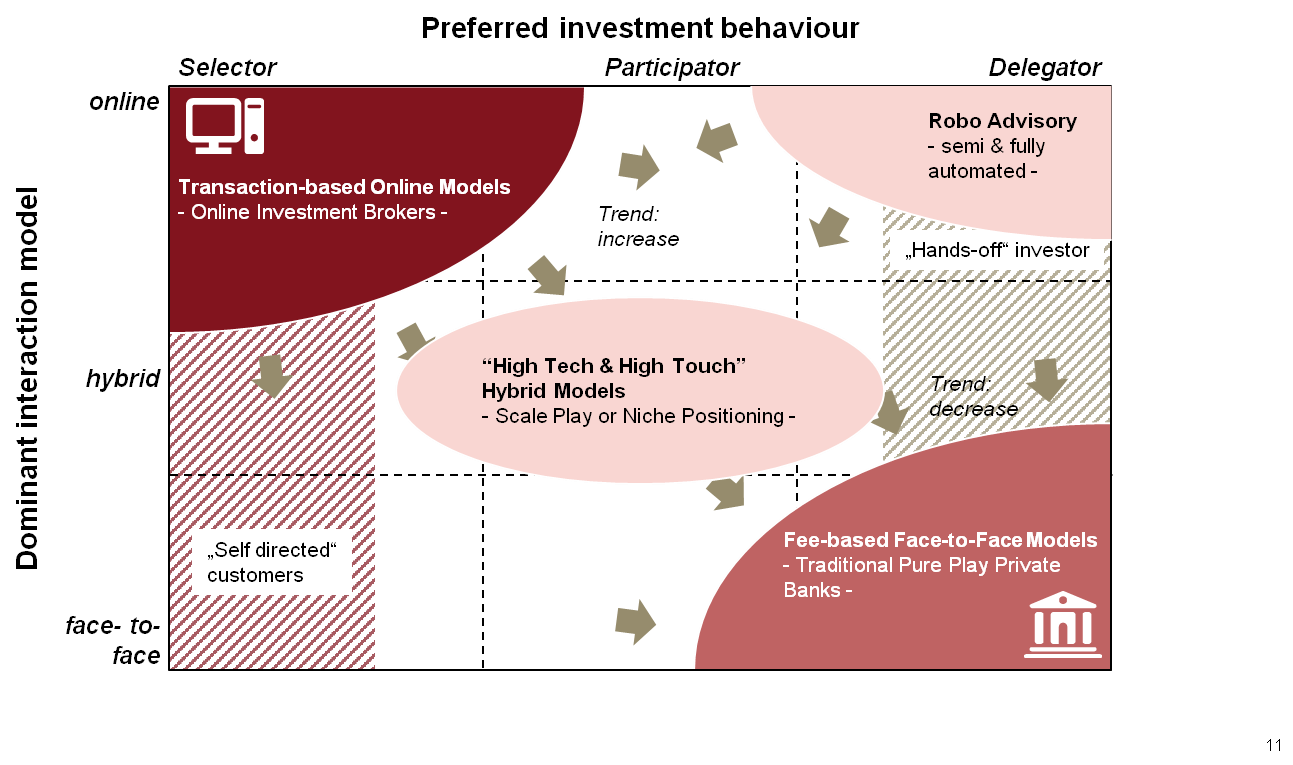

In the WealthTech future, Private Banks and Wealth managers will have 4 possible strategies to choose from, within client preferences that ranges from face-to-face communication to a digital only, and from delegators (“manage my wealth”) to self-selectors (“I manage my money myself”). These 4 strategies strategies – (traditional face-to-face models, online-only platforms and robo-advisory, and hybrid models, “high-tech/ high-touch”) can be pursued either stand-alone or even in combination, likely the choice of large, international banks.

Outlook

While it’s hard to predict precisely which technologies will disrupt PBWM and how, it’s clear that the industry will be transformed via WealthTech. Digitisation is forcing players to rethink models and mindsets. They can sit back and react more or less passively to technological developments, or they can view digital transformation as an opportunity to get closer than ever before to their clients. In addition to technological expertise this requires an understanding of people and their behaviour – something that seasoned players in the industry have always had.

References:

PwC Strategy& Global Wealth Management Study “Sink or Swim”, 2016

http://www.strategyand.pwc.com/media/file/Sink-or-swim.pdf

PwC Strategy& Viewpoint “Taking Wealth Management Digital”, 2013

http://www.strategyand.pwc.com/reports/taking-wealth-management-digital